Table of Contents

1. List of Abbreviations 1

2. Introduction 1

3. The FX Spot Market 1

4. The BAP USD/PHP Spot Benchmark Rate 5

5. Benchmark Review 10

6. Officer of the Week 12

7. Dispute Resolution 13

1. List of Abbreviations

| ACI Philippines | ACI The Financial Markets Association |

| BAP | Bankers Association of the Philippines |

| BAP OMC | BAP Open Market Committee |

| BSP | Bangko Sentral ng Pilipinas |

| FX | Foreign Exchange |

| PHP | Philippine Peso |

| USD | U.S. Dollar |

2. Introduction

2.1 This Bankers Association of the Philippines (BAP) Foreign Exchange (FX) Benchmark Guidelines and Principles (“BAP FX Benchmark Guidelines”) is a set of guidelines and principles describing the methodology and review process of the FX benchmark rates.

2.2 This BAP FX Benchmark Guidelines shall govern the US Dollar-Philippine Peso spot benchmark rates.

2.3 The purpose of the BAP FX Benchmark Guidelines is to further enhance the governance structure of the benchmark, increasing public transparency and visibility of the FX spot market consistent with the principles of an organized market.

3. The FX Spot Market

3.1 FX Spot Transaction

3.1.1 It is a contractual agreement between two Parties for the purchase and/or sale by a Party of an agreed amount in one Currency against the other for spot value date delivery.

3.1.2 In the Philippine Peso FX market, two Parties enter into a contractual agreement for the purchase and/or sale by a Party of an agreed amount in US Dollar (USD) against the sale and/or purchase by it to the other Party of an agreed amount in Philippine Peso (PHP). The FX spot transaction is also referred specifically as the US Dollar-Philippine Peso (USD/PHP) spot transaction. The USD is the commodity currency while the PHP is the term currency. This represents the conversion of one (1) US Dollar in terms of Philippine Pesos.

3.1.3 For purposes of this document, spot value date is defined to be trade date + 1 business day (T+1).

3.2 FX Spot Market Participants

3.2.1 For purposes of this document, participants in the FX spot market consist of institutions licensed by the Bangko Sentral ng Pilipinas to operate as universal or commercial banks and which are: (a) duly authorized by the Bangko Sentral ng Pilipinas to deal in FX and (b) members in good standing of the BAP.

3.2.2 The following are the participating member banks:

| Local Banks | |

| 1 | Asia United Bank |

| 2 | BDO Unibank, Inc. |

| 3 | BDO Private Bank Inc |

| 4 | Bank of Commerce |

| 5 | Bank of the Philippine Islands |

| 6 | China Banking Corporation |

| 7 | CTBC Bank (Philippines) Corporation |

| 8 | Development Bank of the Philippines |

| 9 | East West Banking Corporation |

| 10 | Land Bank of the Philippines |

| 11 | Maybank Philippines, Inc. |

| 12 | Metropolitan Bank & Trust Company |

| 13 | Philippine Bank of Communications |

| 14 | Philippine Trust Company |

| 15 | Philippine National Bank |

| 16 | Philippine Veterans Bank |

| 17 | Rizal Commercial Banking Corporation |

| 18 | Robinsons Bank Corporation |

| 19 | Security Bank Corporation |

| 20 | Union Bank of the Philippines |

| Foreign Banks | |

| 21 | Australia and New Zealand Banking Group, Ltd. |

| 22 | Bank of America, NA – Manila Branch |

| 23 | Bangkok Bank PCL-Manila Branch |

| 24 | Bank of China (Hongkong) Limited-Manila Branch |

| 25 | Cathay United Bank Co. Ltd.-Manila Branch |

| 26 | CIMB Bank Philippines Inc |

| 27 | Citibank, N.A |

| 28 | Deutsche Bank AG |

| 29 | First Commercial Bank Ltd., Manila Branch |

| 30 | Hua Nan Commercial Bank Ltd., Manila Branch |

| 31 | The Hongkong and Shanghai Banking Coporation, Ltd. |

| 32 | Industrial and Commercial Bank of China Limited-Manila Branch |

| 33 | ING Bank N.V. |

| 34 | JP Morgan Chase Bank, N.A. – Manila Branch |

| 35 | KEB Hana Bank Manila Branch |

| 36 | Mega International Commercial Bank Co. Ltd. |

| 37 | Mizuho Bank Limited, Manila Branch |

| 38 | MUFG Bank Ltd. |

| 39 | Shinhan Bank – Manila Branch |

| 40 | Standard Chartered Bank |

| 41 | Sumitomo Mitsui Banking Corporation |

| 42 | United Overseas Bank Limited, Manila Branch |

4. The BAP USD/PHP Spot Benchmark Rate

4.1 Definition

4.1.1 The BAP USD/PHP Spot Benchmark Rate is registered with the Intellectual Property Office of the Philippines as the BAP AM Spot Weighted Average, also referred herein as Benchmark rate or Fixing rate.

4.1.2 The Spot FX benchmark rate is calculated as per the methodology described in Section 4.3 and is published through various channels as per Section 4.4. While the benchmark rate is made available to the public and may conceivably be used for pricing, settlement and valuation purposes, the BAP does not in any way governs or has jurisdiction over how the benchmark is used by other parties.

4.2 Ownership and Administration

4.2.1 The Benchmark rate is owned and administered by the BAP

4.2.1.1.1 A Benchmark owner is an organization or legal person that owns the intellectual property rights of the Benchmark. The BAP USD/PHP benchmark rate, the BAP AM Weighted Average, is registered with the Intellectual Property Office of the Philippines.

4.2.1.1.2 A Benchmark administrator is an organization or legal person that controls the creation and operation of the Benchmark administration process, whether or not it owns the intellectual property relating to that Benchmark

4.2.2 Every five (5) years the BAP conducts a bidding process or a request for proposal to qualified trading platform providers in order to select system to be used in the trading, calculation and publication of the FX spot benchmark rate. The minimum selection criteria include among others: (a) system delivery capabilities; (b) data management, ownership and publication; (c) subscription, pricing and terms of contract; and (iv) other factors or considerations.

4.2.3 As Benchmark Administrator, the BAP has appointed Bloomberg Finance Singapore L.P (Bloomberg) as trading platform provider for FX spot market participants, and as calculation agent and publication agent for the Benchmark Rate.

4.2.4 While BAP membership consists of FX market participants, the BAP itself is a separate and independent organization governed by its own rules and principles. It is a collective body and is not affiliated nor controlled by any member bank. Moreover, the BAP’s permanent officers and staff are employed by the BAP itself and its employees are not privy to the specific details of transactions entered into by the participants in the FX market.

4.2.5 The administration of the Benchmark rate is performed by a dedicated BAP personnel:

|

Senior Associate Director Bankers Association of the Philippines

Pinky Padronia is a Senior Associate Director at the Bankers Association of the Philippines. She joined the organization in 1999. As a member of the BAP’s senior management, she serves as a subject matter expert on areas involving financial markets, risk management, and banking and securities regulations and public affairs. Prior to joining the BAP, she was a lecturer at the De La Salle University from 2003 to 2004 and a researcher at the Philippine Institute for Development Studies from 1997 to 1999. She earned her Bachelor’s Degree in Agricultural Economics from the University of the Philippines – Los Baños and completed academic requirements for her Master’s Degree in Financial Engineering from the De La Salle University. She obtained her license as a Certified Treasury Professional from the Ateneo-BAP Institute of Banking in 2004 and Diploma in Paralegal Studies from the University of the Philippine College of Law in 2016. For questions or issues related to the Benchmark Rate, please contact Ms. Pinky S. Padronia at email address [email protected] or [email protected]. |

4.2.6 The BAP Open Market Committee (BAP OMC), through its Benchmark Committee, provides independent oversight of the Benchmark Rate and the performance of Bloomberg as trading platform provider and as FX benchmark calculation agent. A description of the BAP OMC and the Benchmark Committee can be found here. The BAP OMC meets monthly and as part of its agenda, it undertakes a review of the BAP Spot Weighted Average to ensure that the benchmark calculation methodology continues to provide rates that are reflective of market conditions. All issues related to the performance of its third-party providers are also discussed during the monthly OMC meetings.

4.3 Benchmark Rate Calculation

4.3.1 The Benchmark rate is calculated by Bloomberg LP in its role as the BAP-appointed Calculation Agent for the Spot FX Benchmark. Since 2018, Bloomberg LP has been appointed by the BAP as the Calculation Agent for the BAP AM FX Spot Weighted Average under the Memorandum of Agreement between BAP and Bloomberg L.P. dated December 2018.

4.3.1.1 Calculation Agent `is a legal entity with delegated responsibility for determining a Benchmark through the application of a formula or other method of calculating the information or expressions of opinions provided for that purpose, in accordance with the Methodology set out by the Administrator.

4.3.1.2 The BAP, as administrator of the Benchmark, shall own and act as custodian of the input data. The administrator also has authority of distribution, which access can be made available to stakeholders and any relevant regulatory authority.

4.3.1.3 Auto capture is the process where data of the authorized submitters are automatically uploaded to the prescribed system by the Calculation Agent and which the benchmark is calculated based on the written rules, procedures and calculation methodology.

4.3.2 Calculation Methodology

a. Qualified FX Transactions – Transactions that meet the following criteria are included in the calculation of the Spot FX benchmark:

i. USD/PHP Spot FX Transactions are executed by BAP member banks, who are duly authorized to engage in FX transactions.

ii. Transactions use the standard value date (T+1),

iii. Transactions have the minimum transaction amount of USD 500,000.00

iv. Transactions must be dealt between 9:00AM to 11:30AM

v. The Benchmark Rate is published on all normal trading business days by 11:35AM.

vi. Cancellation of a trade mapped from 9:00AM to 11:30AM must be confirmed before 11:35AM. Cancellations effected after 11:35AM will be accounted for in the PM statistics.

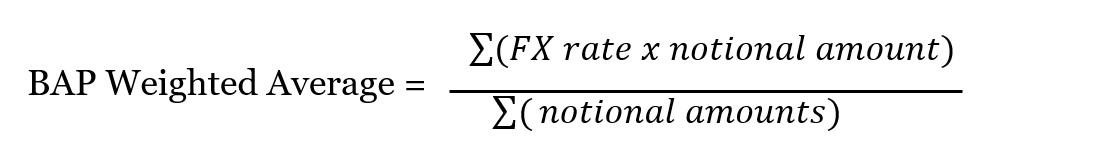

b. Calculation Formula – The BAP AM Weighted Average is the transaction volume weighted average of all qualified FX transactions as per section 3.3.1. This is calculated with the following formula:

Where: FX Rate = the transacted spot rate of a qualified fx transaction

Notional Amount = the USD amount dealt at the specified FX rate

4.4 Benchmark Rate Publication

4.4.1 The Benchmark Rate can be viewed via the following channels: (1) BAP page in Bloomberg terminal at <BAPH>; GO and Philippine Peso Rates or <OTC PH>; GO and (2) BAP website at https://bap.org.ph/.

4.4.1.1 BAP Pages in Bloomberg Pages

(a) <BAPH>; GO

(b) Philippine Peso OTC Rates or <OTC_PH>; GO

4.4.1.2 Bankers Association of the Philippines (bap.org.ph) or

https://bap.org.ph

5. Benchmark Review

5.1 A yearly methodology review is to be done by the BAP in order to ensure that the

benchmark continues to be an appropriate reference rate for the USD/PHP spot

market based on the BAP procedure protocol, see Figure 1 below:

| ACI Philippines | ACI The Financial Markets Association is the official business organization of financial market professionals working in the Philippines and involved in foreign exchange, global fixed income and derivatives markets. |

| BAP | Bankers Association of the Philippines is the lead organization of universal and commercial banks in the Philippines consisting of 44 member banks, 20 of which are local and 24 are foreign bank branches. Then and now, the BAP is an active participant and contributor to the most important milestones in the country’s banking and financial history. It continues to be at the forefront of instituting reforms and introducing best practices for a strong and effacing industry. As banking volume grows, the complexity of transactions evolve and integration of market unfold, the BAP played varied and challenging roles in designing solutions in partnership with the regulators and other market stakeholders for continued financial stability and economic development of the country. |

| BAP OMC | BAP Open Market Committee acts on all queries and requests pertinent to open market issues and on matters related to treasury business, operations and procedures. The BAP OMC ensures the continuing development of the treasury market by formulating and enhancing treasury products and services.

To focus on specific treasury markets, products and programs, the BAP OMC has the following subcommittees covering : (i) Benchmarks; (ii) Interest Rates; (iii) Foreign Exchange; (iv) Derivatives; and (v) Treasury Certification Program and Treasury Education. |

| Bloomberg | Bloomberg L.P. is a global financial market trading, system and information provider that is a Delaware USA limited partnership with principal place of business at 731 Lexington Avenue, New York, NY 10022, USA |

| BSP | Bangko Sentral ng Pilipinas is the central bank of the Philippines

|

6. Officer of the Week

6.1 There shall be an Officer of the Week (OW) to be designated by the BAP Open

Market Committee (BAP OMC), who shall be responsible for monitoring the

proper observance of the BAP Spot Convention among market participants, the

BAP and to certain extent necessary, by the BSP.

6.2 Criteria and Procedure for Choosing the OW

6.2.1 Twelve (12) banks will selected and rotated to be OW, serving as an OW

each for a period of two (2) weeks.

6.2.2 The twelve (12) most active banks in terms of aggregate USD/PHP spot

turnover for the immediately preceding period of six (6) months shall be chosen on a semi-annual basis as the twelve (12) banks eligible to serve as

OW. The selection shall be based on the list of the most active banks as will

be provided by the BSP.

6.2.3 Every six (6) months, the list of OW will be reviewed and revised in accordance with the list provided by the BSP. The assigned schedule for the OW will be announced prior to the start of each six-month period.

6.3 Responsibilities of the Officer of the Week

6.3.1 Monitor the conduct of trading in the BAP Spot Market

6.3.2 Answer queries and clarify issues on matters affecting the BAP Spot Market

6.3.3 Report errors on the statistics, amendments and cancellations to the Calculating Agent for immediate resolution

6.3.4 Refer any dispute to the Arbitration Committee as set forth under Section 7 and may serve as a resource person for this purpose.

6.3.5 The BAP Open Market Committee may promulgate and issue further guidelines for the performance of other duties and responsibilities of the Officer of the Week not specified in this section.

7. Dispute Resolution

7.1 In case of disagreements or disputes between dealers over the interpretation or implementation of these Conventions, any involved party may bring the dispute to the attention of the OW. The OW shall mediate the dispute and try to settle the issue.

7.2 If the dispute remains unsettled within the next trading day, the OW or any of the involved parties may bring the issue to the attention of the Arbitration Committee, which, upon determination of observance of the foregoing procedure, shall henceforth assume jurisdiction over the issue.

7.3 A majority decision of the Arbitration Committee shall be considered final and executory.